Warren Buffett, the legendary investor known as the "Oracle of Omaha," has made headlines with his recent investments in satellite companies. His firm, Berkshire Hathaway, has significantly increased its stake in companies like Liberty SiriusXM Group and Sirius XM Holdings. But what's behind Buffett's interest in these satellite companies, and why should investors (you) take note?

Understanding Buffett's

Investment Philosophy

Warren Buffett is renowned for his value investing approach, which focuses on identifying undervalued companies with strong long-term prospects. His strategy emphasizes understanding a business's fundamentals, its management, and ensuring a margin of safety in the purchase price. This disciplined approach has consistently outperformed the market, making Buffett's investment decisions highly influential.

Techniques Used

Thorough Fundamental Analysis: Buffett conducts a deep analysis of a company's financial statements, including its balance sheet, income statement, and cash flow statement. He looks at metrics like profit margins, debt levels, and return on equity (ROE).

Evaluating Competitive Advantage: Buffett assesses whether a company has a durable competitive advantage, such as strong brand recognition, patents, or cost leadership.

Assessing Management Quality: He examines the track record of the company's management, their decision-making history, and their approach to handling challenges and opportunities.

Margin of Safety: Buffett ensures there is a margin of safety in his investments by buying stocks at prices significantly below their intrinsic value. This provides a buffer against potential errors in his analysis or unforeseen market fluctuations.

Buffett seeks companies that are undervalued by the market. He calculates the intrinsic value of a company and compares it to the current market price. If the purchase price is significantly lower than the intrinsic value, he considers it a good investment.

WHY A SATELLITE COMPANY

Growth Potential

Satellite companies like Liberty SiriusXM Group and Sirius XM Holdings operate in the subscription-based satellite radio service industry. These companies offer a wide array of music, sports, entertainment, and news channels to their subscribers. The growth potential in this industry is significant, as more consumers seek diverse and high-quality entertainment options.

Value Proposition

Despite facing challenges, satellite companies present a compelling value proposition. Buffett's recent investments indicate his confidence in the long-term prospects of these companies. By acquiring shares at a price he believes to be undervalued, Buffett aims to capitalize on the potential upside as the market recognizes the true value of these companies.

Strategic Acquisitions

Berkshire Hathaway's recent acquisitions have been strategic and calculated. For instance, Buffett's firm increased its stake in Liberty SiriusXM Group by purchasing additional shares at a price of $29.76 each. This move reflects Buffett's belief in the company's growth potential and aligns with his value investing philosophy.

ON BASIS OF BUFFET'S TECHNIQUES/PHILOSOPHY

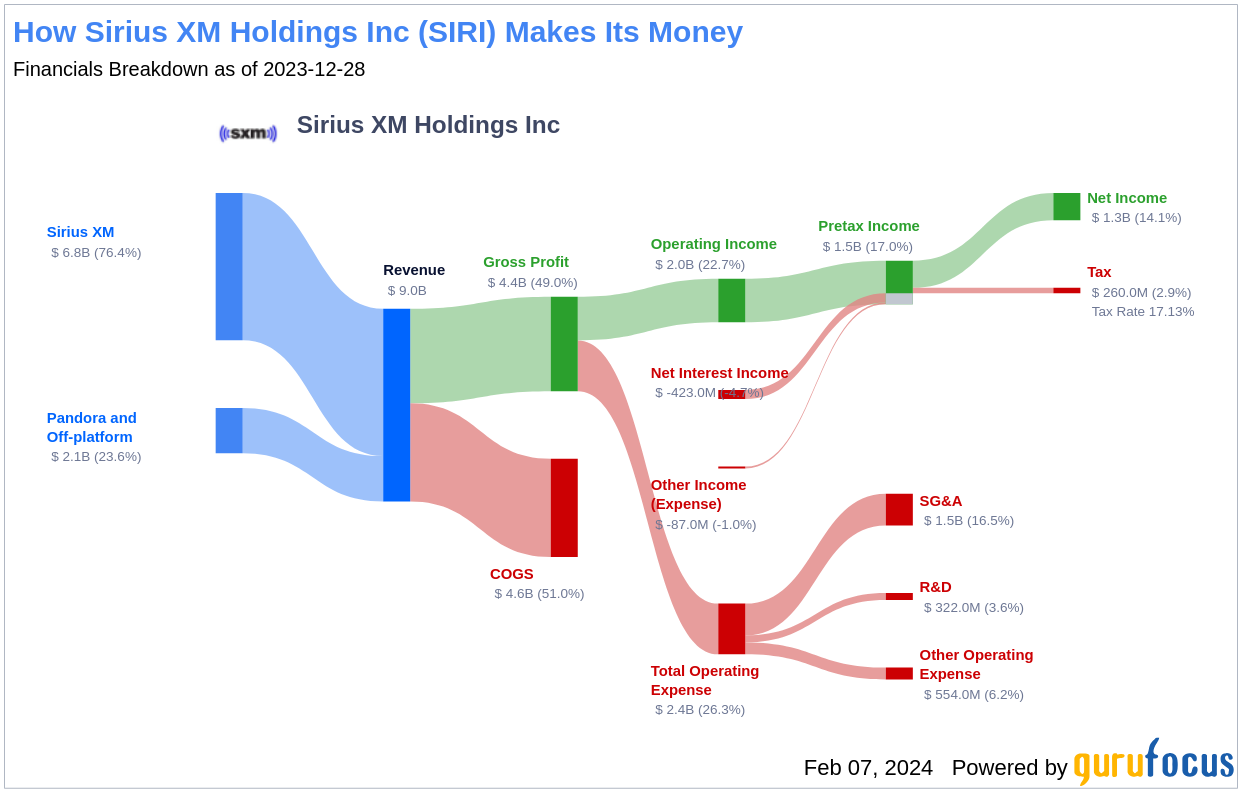

Sirius XM's profit margins have shown variability over recent years:

Gross Margin: Approximately 48.7% in the latest fiscal year, indicating a stable ability to manage production costs relative to revenues.

Operating Margin: Around 22.89%, which reflects operational efficiency after accounting for operating expenses.

Net Profit Margin: Currently at -14.87%, primarily due to significant impairments and restructuring charges impacting net income. This negative margin suggests that while the company generates revenue, extraordinary costs have severely affected profitability.

Earnings Performance

The company's net income has fluctuated significantly, with a reported loss of $1.308 billion in the latest fiscal year due to impairment charges and other unusual items. However, the operating income remains positive at approximately $2 billion, showcasing underlying operational strength despite the losses reported at the net level1.

Balance Sheet Analysis

Debt Levels

Sirius XM's balance sheet reveals substantial debt:

Total Debt: As of the latest reports, Sirius XM's net debt stands at approximately $9 billion, reflecting a leverage ratio (Debt/EBITDA) of around 3.22x. This level of debt is concerning as it indicates a reliance on borrowed funds to finance operations and growth23.

Debt to Free Cash Flow Ratio: The ratio is about 7.46x, suggesting that while the company generates free cash flow, it is still heavily leveraged relative to its cash generation capabilities.

Asset Management

Total assets are reported at approximately $12.94 billion, with liabilities totaling around $15.11 billion, leading to a negative equity position of about -$2.56 billion. This indicates that the company has more obligations than assets, which can be a red flag for potential investors.

Cash Flow Statement Analysis

Free Cash Flow

Sirius XM has consistently generated positive free cash flow, reported at around $919 million recently, which is crucial for servicing its debt and funding operations without additional borrowing. The free cash flow margin has been around 10.44%, demonstrating effective cash generation relative to revenues14.

Cash Flow from Operations

The operational cash flow remains robust, allowing Sirius XM to maintain dividend payments despite its net income losses. The company’s ability to convert earnings into cash is vital for sustaining operations and investing in growth opportunities.

Return on Equity (ROE)

Currently, ROE figures are not available due to the negative equity situation; however, when the company returns to profitability and equity stabilizes, ROE will become a critical metric for assessing shareholder returns.

Intrinsic Value Assessment

Determining Sirius XM's intrinsic value involves evaluating its future cash flows against its current market price:

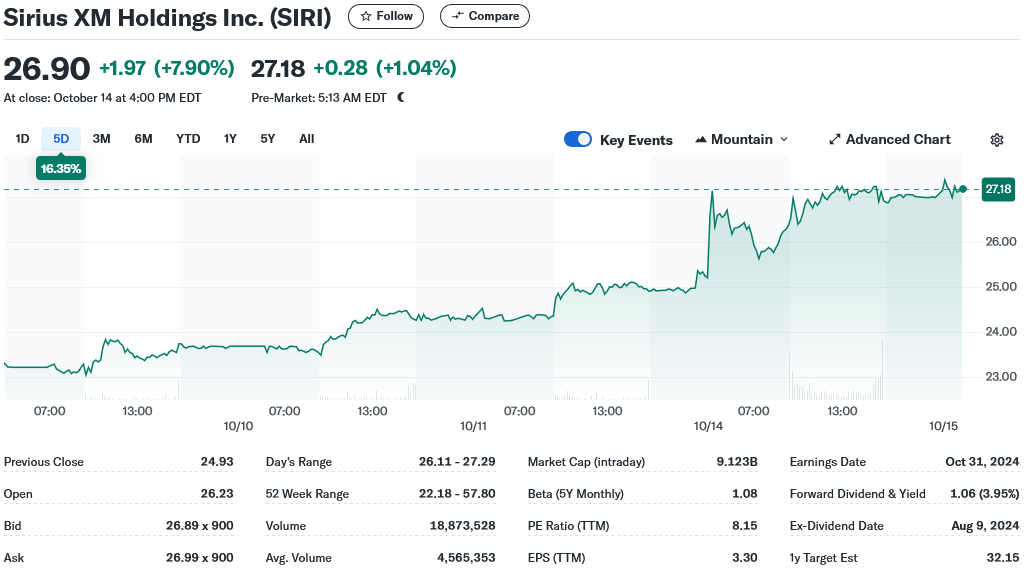

- The company's price-to-earnings (P/E) ratio is low at around 7, suggesting that it may be undervalued compared to industry peers.

- Analysts project earnings growth of approximately 12% annually over the next five years, indicating potential for future appreciation in stock value if operational challenges are addressed effectively56.

Intrinsic Value

The intrinsic value of Sirius XM Holdings is determined by its earnings, growth potential, and risk profile. Analysts have provided varying price targets based on their assessments of the company's financial health and strategic initiatives.

Impact on Berkshire Hathaway's Portfolio

While these investments represent a relatively small portion of Berkshire Hathaway's extensive portfolio, they are significant in terms of share change. Buffett's confidence in these satellite companies underscores his belief in their value proposition and future performance. This strategic addition highlights Buffett's ability to identify opportunities that others may overlook.

SiriusXM's Reverse Stock Split STRATEGY

In February 2024, SiriusXM announced a 1-for-3 reverse stock split, effective March 6, 2024. This corporate action reduced the number of outstanding shares while proportionally increasing the share price. The move was primarily aimed at improving the company's market perception and attracting institutional investors2. Following the split, SiriusXM's stock price tripled from around $4 to $12 per share, though the overall market value remained unchanged. This strategy aligns with the company's efforts to enhance its appeal to a broader range of investors and potentially increase liquidity in its stock. While reverse splits can sometimes be viewed as a sign of financial distress, in SiriusXM's case, it appears to be part of a broader strategy to strengthen its market position and investor base.

Invest in Sirius XM Holdings

Choose a Brokerage Platform

Before you can invest in Sirius XM Holdings, you'll need to choose a brokerage platform. Some popular options include:

- Tastytrade: Known for its user-friendly interface and comprehensive research tools.

- SoFi Invest: Offers commission-free trading and various investment options.

- OPTO: Provides a robust platform for both beginners and experienced investors.

Open an Account

Once you've chosen a brokerage platform, you'll need to open an account. This typically involves providing some personal information and verifying your identity.

Fund Your Account

After setting up your account, you'll need to deposit funds. You can do this by linking your bank account or transferring funds from another trading account.

Place Your Order

With your research complete, you can place your order. Use the platform's search function to find Sirius XM Holdings by its ticker symbol, SIRI. Decide on the number of shares you want to buy and place your order.

Monitor Your Investment

After investing, regularly monitor your investment to stay informed about the company's performance and market trends.

Always remember these are long-term investments, requires alot patience, however this research clearly shows Sirius XM Holdings will be able to manage annual profit this year.

All the best for your investments!