"I think, a year from now, we will have three $4 trillion market cap companies: Nvidia, Apple, Microsoft." Wedbush Analyst (Dan Ives)

The MICROSOFT IS MOST SUITABLE AND VALUABLE STOCK TO PURACHASE, AND I WILL PROVE IT.

Nvidia to win the race to $4 trillion market cap, according to experts.

The race to reach a $4 trillion market cap is heating up, with tech giants like Apple, NVIDIA, and Microsoft leading the charge. This milestone, once unimaginable, is now within reach for these industry leaders, thanks to the booming artificial intelligence (AI) revolution. Let's dive into the details and see who might cross the finish line first.

Nvidia, Apple, and Microsoft have surpassed the $3 trillion market cap threshold, while Google and Amazon hover around $2 trillion. Collectively, these five companies represent over $14.5 trillion in market value, accounting for approximately 32% of the S&P 500 index. This is a remarkable feat considering that the entire U.S. stock market was valued at just $11.1 trillion in 2002 after the dot-com bubble burst.

The rapid ascent of Nvidia from a $2 trillion to a $3 trillion market cap in less than 100 days exemplifies the volatility and potential of this sector.

Nvidia: Widely regarded as the leader in this race, Nvidia's dominance stems from its pivotal role in the AI revolution. The company's GPUs are essential for running generative AI applications, leading to an insatiable demand for its products. Analysts predict that Nvidia's stock will continue to soar as AI-related capital expenditures are expected to reach around $1 trillion over the next three years.

Microsoft: With a strong foothold in cloud computing and substantial investments in AI technologies, Microsoft is seen as a sustainable contender for reaching the $4 trillion mark. Its diversified revenue streams provide resilience against market fluctuations, making it a solid long-term investment.

Apple: While Apple may not lead initially, its potential for growth is significant. The upcoming iPhone 16 is expected to drive consumer interest in AI features, potentially leading to a supercycle in iPhone sales. Analysts estimate that over 300 million iPhones worldwide have not been up graded in more than four years, indicating substantial room for growth.

Who Will Win?

"NVIDIA is a generational opportunity... its growth potential is exceptional." Vivek Arya (BofA)

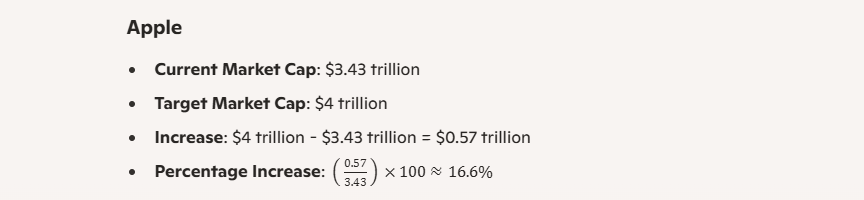

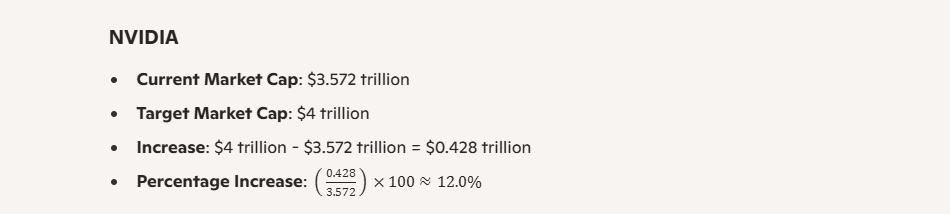

NVIDIA Current Market Cap is $3.62 trillion.

Apple's Current Market Cap is $3.43 trillion.

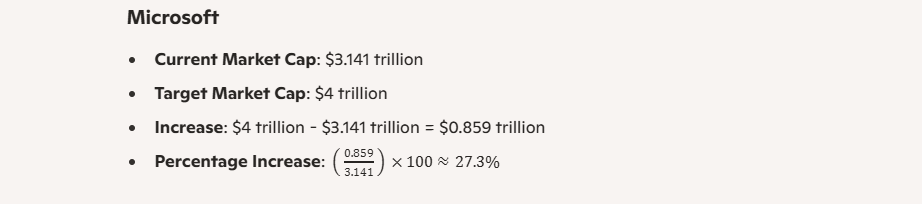

Microsoft Current Market Cap is $ 3.14 trillion.

Now, NVIDIA seems to have a slight edge due to its pivotal role in the AI hardware space and its current market cap, which is the closest to $4 trillion. The rapid ascent of Nvidia from a $2 trillion to a $3 trillion market cap in less than 100 days also determines same.

Most of the experts agreed on the opinion, that NVIDIA might win the race and make history.

But this doesn't mean that NVIDIA is most beneficial for You, Let's see how.

MOST BENEFICIAL SHARE

We all know that in 2025-26, all of these three giants will cross market cap of $4 trillion.

The percentage increase in the 1share price if the market cap of Apple, NVIDIA, and Microsoft reaches $4 trillion, will clearly tell us the most beneficial stock.

Formula:

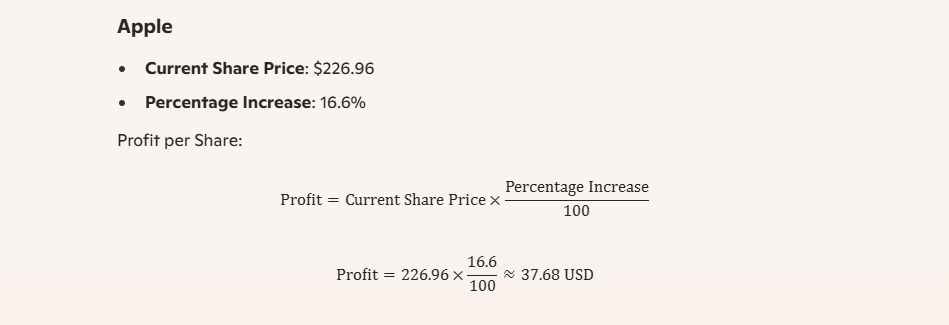

Apple: Approximately 16.6% increase.

NVIDIA: Approximately 12.0% increase.

Microsoft: Approximately 27.3% increase.

Thus, from a percentage gain perspective, Microsoft's shares would indeed be the most profitable if all three companies reach the $4 trillion market cap.

Price of 1 share of Microsoft is $422.54.

Price of 1 share of Nvidia is $147.63.

Price of 1 share of Apple is $ 226.96.

Profits per Share

- Apple: Approximately $37.68 USD per share.

- NVIDIA: Approximately $17.72 USD per share.

- Microsoft: Approximately $115.34 USD per share.

The following facts clearly shows that MICROSOFT is the most valuable share where as NVIDIA will be first one to reach market cap of $4 trillion.